By Paul van Eeden

I received an interesting question about company valuations from one of my newsletter subscribers that I thought I would address as a Commentary. It is a multi-part question that will take more than one Commentary to address; this week is part one: Valuing Mining Stocks.

Mining is a finite business. Mineral deposits contain a certain amount of ore and when that ore is mined out the deposit is depleted, no matter what you do or wish.

That is in stark contrast to say, an auto parts manufacturer, who can adapt to new demands and specification changes and (hopefully) stay in business for many decades. When you value an auto parts company, you can compare the companys price to earnings, price to cash flow, operating margin and net profit margin (among other things) to the companys peers to assess whether the stock in question is relatively cheap, or relatively expensive. You can also get a sense of whether the stock is cheap or expensive in an absolute sense by looking at the book value per share and comparing things like the profit margin and dividend rate to prevailing interest rates. But, embedded in all this (except book value per share) is the implicit assumption that the earnings and cash flow are for all intents and purposes infinite. When you are dealing with a business that can be reasonably expected to continue in a similar fashion for many decades, earnings per share, cash flow per share, dividend rate, etc. are meaningful. That is not the case with mining.

Take a hypothetical mining company that has only one mine as an example. Let us assume that mine is going to produce for another five years before the ore will be depleted. Now, let us say that the companys price to earnings ratio is ten. A hypothetical auto parts manufacturer also has a price to earnings ratio of ten. Based on just this one metric, we cannot differentiate between the two stocks. Let us also assume that the prevailing ten-year interest rate is five percent.

This means that you can invest your money in a ten-year bond and earn five percent per year while taking relatively little risk (other than the risk of interest rates rising, which could negatively impact all the investments under consideration and is therefore not considered).

The auto parts manufacturer has a price to earnings ratio of ten. That means for every dollars worth of stock you buy, you expect to earn ten cents, or ten percent, in earnings. It does not really matter for our purposes whether those earnings are retained by the company or paid out as a dividend since, either way, the earnings accrue to the benefit of shareholders. Furthermore, you can reasonably assume that the auto parts manufacturer is going to be in business for several more decades and, because you have done lots of due diligence, you can also assume that the future earnings are likely to be the same as the current earnings. So, if you buy the auto parts stock, you will earn ten percent per year as opposed to five percent on your bonds. The auto parts stock is probably riskier than a bond; however, if you can make twice as much money it might be tempting.

Then you look at the mining stock and notice that it, too, has a price to earnings ratio of ten and, therefore, you can also make ten percent a year if you bought that stock. But you would be wrong. The mining companys mine only has a five-year life ahead of it. So, if it has a price to earnings ratio of ten it means that for every dollar of stock you buy you get ten cents in earnings. But the earnings are only going to last another five years, so your total earnings per dollar of cost will only be fifty cents — - half of what you paid for the stock — - and then the mine is depleted. Thats why comparing a mining stock to other investment opportunities on the basis of price to earnings, price to cash flow, or dividend yield is complete nonsense. It is just as futile to compare mining stocks to each other based on these metrics because mining companies have different mine lives in their operations.

The only reasonable way to evaluate a mining company is to look at the net present value of the potential future cash flow, discounted at an appropriate discount rate. You have to take into account not just the cash flow that the mine(s) is generating, but also sustaining capital costs (including future exploration and development costs) associated with keeping the mine in production. Assuming you can derive a suitable cash flow model for each mine that a company owns you can then calculate the net present value of future cash flow by using an appropriate discount rate to represent the geological, political, social and financial risks. If you sum all the net present values together, add any other assets on the balance sheet and subtract any debt, you will arrive at the net asset value per share. In a rational world you would expect to pay no more for a mining stock than its net asset value per share — - how do you expect to make money if you consistently pay more for stocks than what they are worth? But, in the real world, mining stocks almost always trade for more than the net asset value of their constituent mines, and for a good reason.

Mining stocks also offer leverage to commodity prices. Take a gold mining company as an example. Assume we have a company that mines gold for a total cost of $400 an ounce, and let us pretend the gold price is $500 an ounce. The net present value of the mine would be calculated based on the $100 margin. If the gold price increases by 20% to $600 an ounce the net present value of the mine will double, since the margin would now be $200 an ounce. Thus the value of the company increased five times more than the increase in the gold price. Most people buy mining stocks because of this leverage.

What should be immediately evident is that if you pay more for mining stocks than what they are worth, on the speculation that the price of the underlying commodity will increase, you are merely gambling on the commodity price. Fortunately there is a way to quantify the premium that one should pay for a mining stock to incorporate the leverage it has to the underlying commodity price. There is a formula called the Black-Scholes Model that can be used to calculate the "option" value of a mining stock [Editors note, you can find more information on the Black Scholes model and further links at http://en.wikipedia.org/wiki/Black-Scholes ]. What should be done is to calculate the discounted net present value of the all the companys mines and then add the "option value" of the mines as calculated by the Black Sholes formula to obtain a more realistic asset value per share. By adding the optionality of mining shares to the net present value of the mines themselves we can account for the fact that mining shares trade at a premium to their net asset value because of their leverage to the underlying commodities.

If you calculate the net asset value of a mining stock as described above you will get a result that can be used to compare different mining companies to each other, and mining companies to investments in other sectors. Unfortunately, very few mining analysts employ the Black Sholes model to calculate mining net asset values, so for most people buying mining stocks really comes down to blind speculation on commodity prices.

-

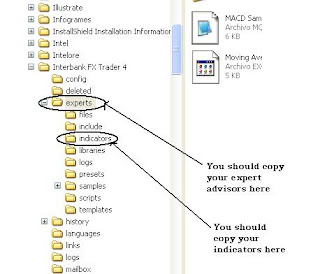

- 4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

-

- -

- -

-