The website starts with nothing but bold claims about the system being able to "pump" tens of thousands of dollars every week out of the market. After this we see that the forex cash factory website is nothing more than a few thousands words of a guy telling us to buy something just because it can make us rich. The webpage is definitely geared towards people who are new to the forex market and are definitely looking for a way to get money quickly.

The author of the forex cash factory fails to give many important descriptions about his system. There is absolutely no mention of the profit or the risk targets of the system, no mention of the money management used when trading, no mention of the characteristics of the strategy, etc. Why would anyone buy a trading system they know nothing about ? The guy fails to explain if his system relies on scalping, swing trading, long term trading, etc. There is simply almost no information abou tthe actual trading system included on the website. The author could have written the webpage without any product because product description is extremely limited.

There is also absolutely no evidence about the profitability of the system or its ability to even produce one USD on the forex market. The thing I find the strangest is that the guy does mention on his website that the system WAS actually tested on a real account for three years before selling it. Why in the world doesnt this guy show this evidence of profitability if it does exist in reality ? Come on ! Who would refrain from posting such evidence if it is obvious that it would increase sales enormously ? No one would ! The fact remains that until the evidence is not posted, it may as well not exist, there is no reason to believe it does.

Then what about all those testimonials ? I can also sit down and makeup whatever testimonial I want, testimonials do not mean anything, specially when a "testimonial" is just a bunch of text there. All the testimonials could have been written by the author, there is no doubt about that. What you should ask for when looking for a trading system, either manual or automated, is not simply a 2000 long sales page telling you how good your life will be after you make the purchase but solid evidence showing that the system has been profitable in the past and has a high like hood of remaining profitable in the future. Why is this evidence never shown for manual trading systems ? Well, mainly because the systems usually only work for one thing, bringing the author sales profits.

In the light of the total lack of even a general description of the system and the absolute lack of any performance record of the system when there is even mentioning that such a record exists (which means that the author is purposefuly hiding it or making that up) I consider the cash factory manual trading system not worth buying and testing. If you want to know more about trading system and how you too can design and trade your own long term profitable automated systems with realistic profit and risk targets please consider buying my ebook on automated trading or subscribing to my weekly newsletter to receive updates and check the live and demo accounts I am running with several expert advisors. I hope you enjoyed the article !

-

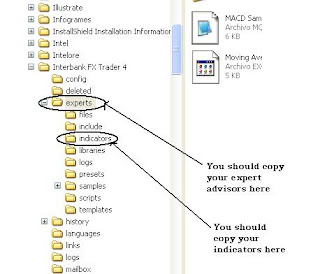

- 4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

-

- -

- -

- -

- -

-