Many people who are new to automated forex trading are puzzled by installation issues regarding the expert advisors for the metatrader platform. This easy to follow graphical guide will show you the simple steps necessary to setup an expert advisor for the metatrader 4 platform.

-

1. Download your expert advisor file and indicators (if the ea needs any custom ones). These are either ex4 or mq4 format files, depending on if they are a source or a binary (precompiled file). There is no difference between these two classes as far as installation and usage goes.

-

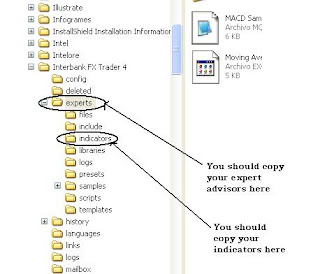

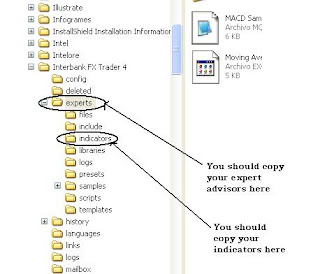

2. Copy your expert advisor files and indicator files to the corresponding directories. As it is shown in the following picture. Keep in mind that this directories are located under your metatrader installation path and that metatrader should not be running at this point.

-

-

-

3. You should now open up metatrader. Open up a chart with the timefrime and currency pair in which you want to run the advisor. Now simply drag and drop the expert advisor from the navigator window as shown in the next picture.

-

4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

-

-

-

5. Now you should check that the expert is running. A happy face should show up in the top right corner of the chart you chose. If you see an x or a happy face it means you neglected to perform the last step (or didnt perform it correctly).

-

-

-

Happy trading !

1. Download your expert advisor file and indicators (if the ea needs any custom ones). These are either ex4 or mq4 format files, depending on if they are a source or a binary (precompiled file). There is no difference between these two classes as far as installation and usage goes.

-

2. Copy your expert advisor files and indicator files to the corresponding directories. As it is shown in the following picture. Keep in mind that this directories are located under your metatrader installation path and that metatrader should not be running at this point.

-

-

-3. You should now open up metatrader. Open up a chart with the timefrime and currency pair in which you want to run the advisor. Now simply drag and drop the expert advisor from the navigator window as shown in the next picture.

-

4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.

4. Now you need to check the live trading dialogue and change any settings you would like to modify on the expert advisor, as it shown. Also remember to click on the expert advisor button on the upper section of the program to allow trading.-

-

-5. Now you should check that the expert is running. A happy face should show up in the top right corner of the chart you chose. If you see an x or a happy face it means you neglected to perform the last step (or didnt perform it correctly).

-

-

-Happy trading !